has capital gains tax increase in 2021

Capital Gains Tax Rates 2021 To 2022. Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth.

Capital Gains Tax Hikes And Stock Market Performance Fox Business

The proposal would increase the maximum stated capital gain rate from 20 to 25.

. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

Those tax rates for long. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Its time to increase taxes on capital gains.

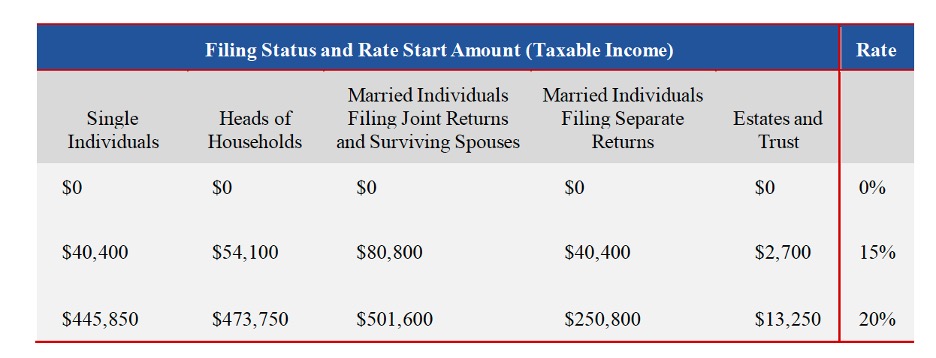

Biden plans to increase this to 434 percent for households earning. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

The Chancellor has long been rumoured be considering bringing capital gains tax rates more in line with income tax. But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. In 2021 and 2022 the capital gains tax rate is 0 15 or 20.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Connect With a Fidelity Advisor Today. To address wealth inequality and to improve functioning of our tax.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. Posted on January 7 2021 by Michael Smart.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20.

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Trade Nears Potential Deadline As Legislation Looms

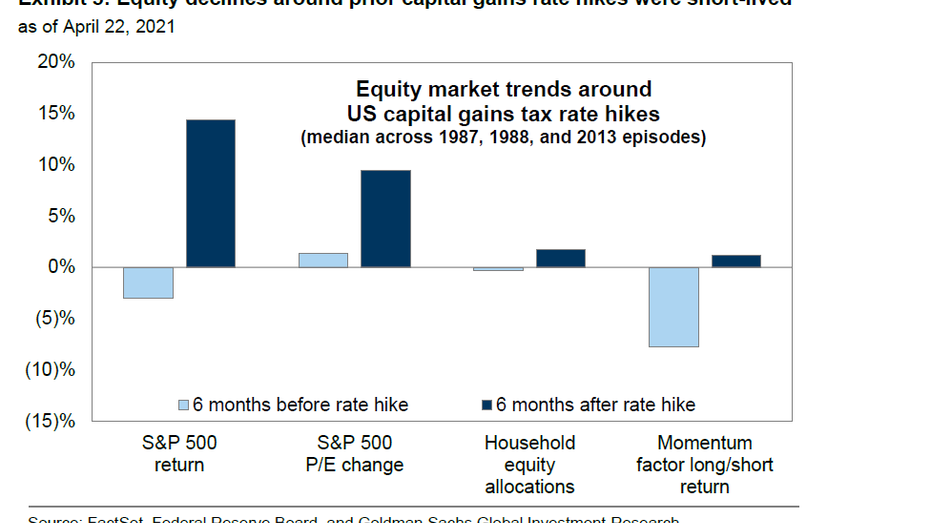

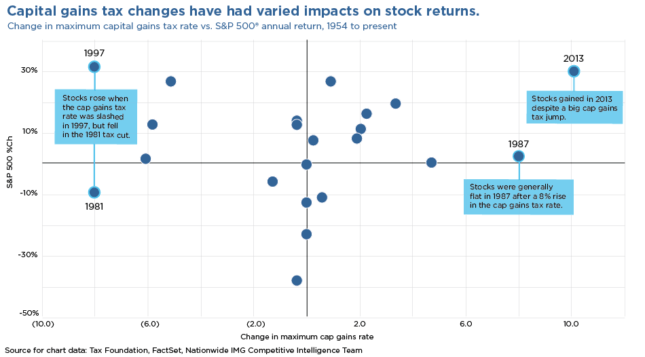

Carl Quintanilla On Twitter Correlation Between Capital Gains Tax And Market Returns 1968 2021 Via Johnspall247 Https T Co Gkocg8xlrw Twitter

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

It S Time To Repeal This Unfair Tax Giveaway New Mexico Voices For Children

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Congress Readies New Round Of Tax Increases

Oregon S Capital Gains Tax Is Too High Oregonlive Com

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Short Term And Long Term Capital Gains Tax Rates By Income

Understanding The Capital Gains Tax Hereford Financial

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca